In the past decade, China has spent over $100 billion to boost the growth of the intelligent electric vehicle (IEV) industry. As a result, China now owns the most sophisticated IEV supply chain and is the largest IEV market in the world. While the dominant argument is that China made this investment to reduce greenhouse gas emissions, I argue that this investment is having a much more profound impact on China’s economy. The IEV supply chain, including its talent pool, technologies, and manufacturing capabilities, will trickle down to empower various segments of the robotics and automation sector, thus accelerating China’s economic transformation into the automation age.

In the context of globalization, China’s economy has benefited from its enormous supply of low-cost labor by serving as the world’s factory. However, as labor costs rise and its population ages rapidly, China may no longer enjoy that demographic dividend. In fact, many companies are moving their factories out of China. To avoid falling into the middle-income trap, a structural change to China’s economy is imperative.

Historically, only a few countries have ever succeeded in escaping the middle-income trap, and no country with an aging population ever did so. Nonetheless, traditional economic structural change theories are human-centric, such that the human labor force is the source of productivity. Today, technological innovations enable robots to handle many agricultural, industrial, and service tasks. As robots become more ubiquitous in our daily lives, robots can be a source of productivity – and thus, robots can rescue China from the middle-income trap. Indeed, we have seen various forms of robots integrating into the daily lives of the Chinese people, whether it is food delivery robots on the street or cleaning robots at home.

For China’s economy to transform into the automation age, a complete robotic technology supply chain needs to be developed. The key components of this supply chain include artificial intelligence (AI) software, batteries, sensors, computer chips, and servo motors. All of these components are required in IEVs as well, albeit with a larger volume and more strict technical requirements. China’s heavy investment in the IEV industry has generated fierce competitions in these technical areas, which will lead to overprovisioning of production capabilities as well as rapid drops in cost. Consequently, the robotics and automation sector will benefit from this to produce robots that are effective and cost-efficient.

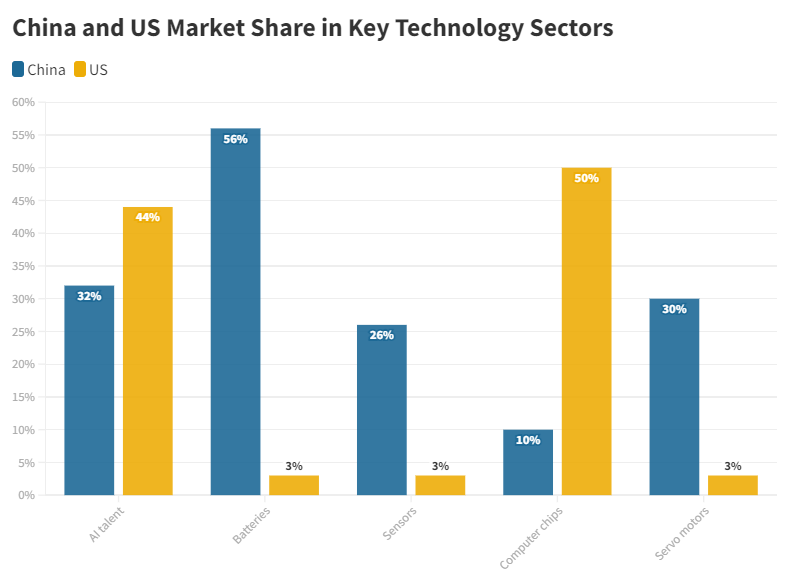

Now let us examine the key components of the robotic technology supply chain. The following figure compares the robotic technology supply chain market share between China and the United States.

First, both U.S. and China are leading on AI talent, with China accounting for 32.3 percent and the U.S. 44.2 percent of the global AI talent. It’s no coincidence that many AI talents work in IEV companies, such as Tesla in the United States and Baidu in China. From my personal experience, in China, AI talent mobility is very active between the IEV industry and the robotics and automation sector, due to the fact that many AI technologies developed for IEVs can also be used for various types of robots. This is also verified by Tesla’s recent move to produce Tesla bot.

While currently the United States leads on AI talent, recent trends may change that. China generates more STEM graduates than the U.S., and increasingly more technology talents are moving back to China from the U.S. and Europe. With a thriving IEV industry and a promising automation and robotics sector, China may soon develop the world’s biggest AI talent pool.

As the world’s factory in the mobile phone era, many Chinese companies became key iPhone suppliers, especially battery companies. As a result, China is already dominating the global battery market, providing more than 56 percent of world’s batteries. In comparison, since battery manufacturing is considered a high-pollution industry, the United States has outsourced most battery manufacturing overseas. Realizing this problem, the U.S. government is trying to bring battery manufacturing back through the Inflation Reduction Act of 2022.

Sensors, especially LiDAR sensors, are essential for IEVs and robots. Although U.S. companies are pioneers in sensor technologies, Chinese sensor suppliers have experienced tremendous growth in recent years, benefiting from China’s booming IEV industry. Today, Chinese sensor suppliers own 26 percent of the global market, whereas U.S. companies only own 3 percent. In addition, Chinese suppliers are still growing rapidly whereas U.S. companies’ market share continues to shrink.

Servo motors determine the precision and controllability of robots, especially industrial robots. Japanese manufacturers dominate this area due to their technological advantages, but Chinese manufacturers have been growing rapidly due to their cost advantages. Today, Chinese manufacturers have a 30 percent share of the global market whereas the U.S. presence is almost negligible. Similar to how China’s IEV industry incentivized the growth of battery and sensors supply chain, it is reasonable to project that Chinese servo motor suppliers will grow rapidly with China’s robotics and automation sector, and they will gain global market share in the foreseeable future.

Although China’s booming IEV industry has incentivized the growth of many technical areas, computer chips have always been China’s weak point. Today the United States still dominates the global microprocessor market, especially high-end AI processors. Realizing the strategic importance of microprocessors, the U.S. Congress recently passed the CHIPS and Science Act of 2022 to further strengthen domestic semiconductor manufacturing, design, and research. In addition, Taiwan Semiconductor Manufacturing Company’s recent opening of a new plant in Arizona is another big win for the U.S. semiconductor industry. Without an advanced microprocessor supply chain, China still has to rely on U.S. supply to sustain the growth of its robotics and automation sector in the foreseeable future.

In summary, China’s enormous investment on the IEV industry will not only make China greener, but more importantly accelerate China’s economic transformation into the automation age. Examining the supply chains reveals that China has gained, or is on the way to gain, dominance in many key technological areas of the robotics and automation sector. If this trend continues, we may soon find ourselves in a world powered by Chinese robots.

China’s Trickle-Down Supply Chain: From Intelligent Electric Vehicles to Robots

Source: Frappler

0 Comments