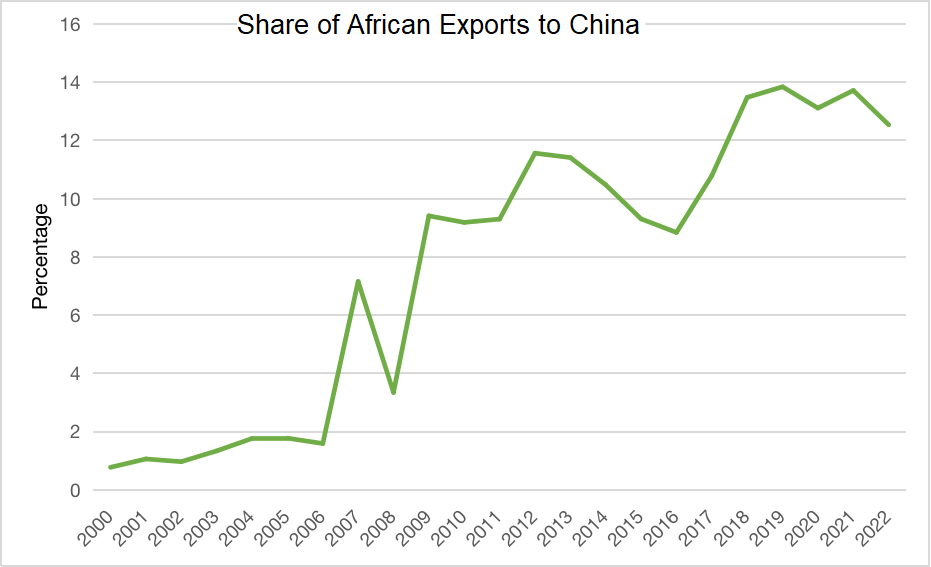

For African governments and firms looking for new export markets, China can seem like a golden opportunity. While African exports to China currently account for just 3 percent of Chinese global imports, China is becoming a relatively more important market for Africans. In 2022, 12.5 percent of Africa’s exports went to China, compared to a mere 0.8 percent at the beginning of the century.

According to Chinese official statistics, the total trade value between China and Africa hit an all-time high in 2022, at $276.5 billion, reflecting a 14.5 percent increase compared to the previous year. Importantly, imports from Africa accounted for $114.9 billion, a 14.2 percent year-to-year rise.

The unique aspect of this trade relationship is not the figures, however; it’s the types of activities China has used to promote trade. A key example is the China-Africa Economic and Trade Expo (CAETE). The expo was first held in China’s Hunan province in June 2019 and has been held every two years since, with the third edition about to take place. Organized by China’s Ministry of Commerce (MOFCOM), the CAETE is the only economic and trade cooperation platform within the broader Forum on China-Africa Cooperation (FOCAC) framework. It’s unusual because few other African trade partners hold these sorts of promotional events.

The question is whether it has had an impact, and therefore whether the forthcoming third expo will make any difference at all.

The first expo saw the signing of 84 cooperation deals worth $20.8 billion, covering aviation, tourism, manufacturing, and infrastructure, among other sectors. China Global Television Network (CGTN) reported that at least 1,000 African guests and traders attended this first expo. Our own team at Development Reimagined organized a dedicated space for several African brands to showcase their value-added products to Chinese consumers.

As a pilot, the CAETE certainly showed off China-Africa economic diplomacy, as well as the local government’s strong intention to engage further with the continent. And even at the company level, the African brands that participated did find themselves for the first time genuinely excited about the potential of the Chinese market.

The second expo was both more and less successful than the pilot. It was eventually held in September 2021, when the world was still in the throes of the COVID-19 pandemic. While China was fairly open internally, its borders were mostly closed and very closely managed. This meant the expo had significantly less physical attendance, and the organizers had to utilize online conferences, exhibitions, as well as transactions. CGTN reported that during the second expo, roughly 176 projects valued at an overall lower $15.93 billion were signed. That said, our impression when helping to promote the products of a new set of African brands in China at the expo was that Hunan’s capacity to organize and attract serious sellers, buyers, and distributors had certainly grown over the previous two years.

Fast forward to today. The third CAETE opened on June 29 with representatives from 53 African countries and eight international organizations. The guests of honor include African dignitaries from Benin, the DRC, Ghana, Madagascar, Malawi, Morocco, Mozambique, Nigeria, and Zambia. During the expo, a new “China-Africa Trade Index” will be launched.

But will any of this matter? Will it really make a difference to trade patterns between the African continent and China, however many “deals” are signed? The jury is out. Despite the increase in trade volumes with China, today, 37 African countries still have a trade deficit with China. It’s unlikely that any expo will change this.

However, three shifts differentiate this year’s expo from the previous two, potentially heightening its impact.

First, this time, the African Continental Free Trade Area (AfCFTA) is in force. Back in 2021, the AfCFTA’s Secretary General Wamkele Mene was quoted as saying “This AfCFTA provides the framework for us to continue that collaboration with China,” noting that with the establishment of the AfCFTA, Africa has “overcome the market fragmentation that was there before.” The AfCFTA should in principle make Chinese manufacturers more interested in investing in production in Africa, including making goods for the Chinese market.

Second, several African countries are gearing up for better involvement. For instance, the Zimbabwean Ministry of Women Affairs, Community, Small and Medium Enterprises Development has invited micro, small, and medium enterprises to participate in the CAETE. The Kenya National Chamber of Commerce and Industry (KNCCI) is attending, stating, “The expo will be an opportunity for us to learn about product development as Kenyan businesses.” Reportedly, the KNCCI is planning to open an office in Hunan province to better facilitate interaction with Chinese investors and trade counterparts. For our part, Development Reimagined, with the support of the African Export-Import Bank (Afreximbank), will be assisting a bigger cohort of 20 luxury and sustainable African brands – mostly women-led – to enter the Chinese market, starting with this expo.

Third, the expo and China’s other trade promotion activities have been complemented by recent shifts in trade policy – such as some extensions of duty-free treatment for African Least Developed Countries and semi-preferential free trade agreements, such as that with Mauritius. China has removed non-tariff barriers for 11 new fresh agricultural products from eight African countries since the last expo. In late 2021, China also committed financing of $10 billion for African financial institutions and trade financing.

That said, in our experience, African countries are still facing significant challenges when it comes to tariffs on value-added goods entering China – especially from countries that are part of the AfCFTA but don’t fall under China’s current preferential tariff schemes. This drives up prices and can reduce demand for these goods, negatively impacting the competitiveness of African exporters. This is partly – though not the entire reason – why Africa’s exports to China remain primarily raw materials.

Also, in reality, only fairly limited volumes of new agricultural products (if any) have entered China, both due to bureaucracy on the Chinese side and logistical challenges in African countries. Furthermore, still today, many African banks and SMEs remain unaware of the impact and potential of Chinese trade financing and other funds and have little clue how to access them. This not only undermines the “mutually beneficial” or “win-win” aspect of China-Africa cooperation, but it also holds back the pace of progress. For example, pan-African banks such as Afreximbank have a very strong portfolio in trade finance, and are ready for more investment from China.

The expo represents a unique Chinese set up, Hunan province is better organized than ever, and we may see record numbers and volumes of new deals announced. But the fact is that the expo will not be recognized on the continent or shift trade deficits unless it has a direct impact on African firms and exporters and their banks, especially those producing value-added products, including from the largest economies on the continent. This third China-Africa trade expo will likely be the biggest ever, but it will also be its greatest test.

Does the China-Africa Trade Expo Matter?

Source: Frappler

0 Comments